mckinley61d96

About mckinley61d96

Understanding Personal Loans For Bad Credit: A Case Study

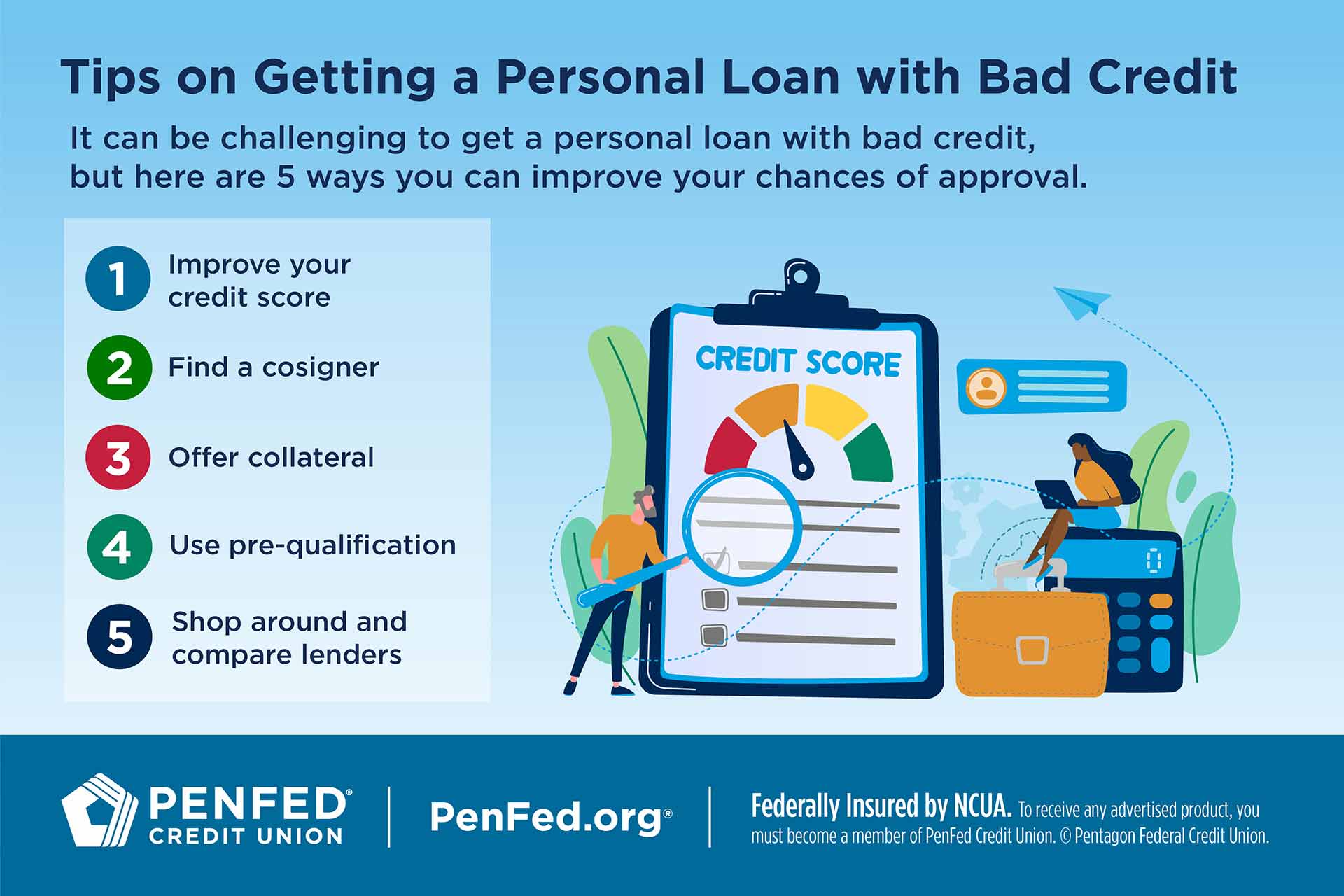

In immediately’s monetary landscape, acquiring a personal loan could be a daunting process, especially for people with unhealthy credit score. This case research explores the challenges and options confronted by individuals searching for personal loans with poor credit score histories, providing insights into how they’ll navigate the lending landscape.

Background

John, a 35-yr-outdated single father residing in a suburban area, discovered himself in a financial bind after dropping his job through the pandemic. If you cherished this post as well as you want to get more information regarding personal loans approved with bad Credit (personalloans-badcredit.com) generously visit our web-site. Despite his best efforts to secure a brand new place, he fell behind on his bills, resulting in a significant drop in his credit score. With a credit rating of 580, John was labeled as having ”unhealthy credit,” which severely limited his options for acquiring a personal loan.

The Problem of Unhealthy Credit

People like John often face numerous obstacles when looking for personal loans. Lenders usually view a low credit score score as an indication of excessive threat, which may end up in higher interest rates or outright loan denial. The following are frequent challenges faced by borrowers with dangerous credit:

- Limited Choices: Many conventional banks and credit unions have strict lending criteria, making it troublesome for those with dangerous credit score to qualify for loans.

- Excessive Curiosity Rates: When loans can be found, they typically come with exorbitant interest rates, which may lead to a cycle of debt for borrowers unable to make well timed payments.

- Predatory Lending: Some lenders exploit individuals with dangerous credit by providing loans with hidden fees and unfavorable terms, further complicating the borrowing course of.

- Lack of Financial Training: Many people with bad credit score might not fully perceive their monetary situation or the implications of taking on extra debt, leading to poor decision-making.

Exploring Choices

Faced with these challenges, John began exploring his choices for acquiring a personal loan. He was decided to search out an answer that will allow him to consolidate his debts and enhance his monetary scenario. Listed here are the steps he took:

1. Researching Lenders

John started by researching varied lenders specializing in personal loans for bad credit. He found that on-line lenders usually have extra flexible lending standards compared to conventional banks. He made a list of potential lenders and compared their curiosity rates, terms, and customer evaluations.

2. Checking His Credit Report

Earlier than applying for a loan, John obtained a duplicate of his credit report to understand the components affecting his credit rating. This allowed him to determine any inaccuracies that he might dispute, in addition to areas for enchancment, reminiscent of paying down current debts.

3. Contemplating a Co-Signer

To extend his possibilities of approval and safe a lower curiosity rate, John reached out to his sister, who had a great credit score rating, to see if she can be prepared to co-sign the loan. Having a co-signer can considerably enhance a borrower’s probabilities of loan approval and should result in better loan terms.

4. Exploring Different Lending Options

Along with conventional loans, John thought of alternative lending options, comparable to credit unions and peer-to-peer lending platforms. These lenders typically have more lenient necessities and may provide higher charges for borrowers with unhealthy credit.

The applying Course of

After careful consideration, John decided to use for a personal loan with an online lender that specialized in loans for people with bad credit. He submitted his software, which included details about his income, employment, and existing debts. The lender supplied him a loan quantity of $10,000 at an curiosity charge of 18%, with a repayment term of five years.

1. Loan Approval

To John’s relief, the lender authorised his loan application within 24 hours. The fast turnaround time was a big advantage, as he wanted the funds to repay his overdue bills and avoid further penalties.

2. Understanding the Phrases

Before accepting the loan, John rigorously reviewed the phrases and conditions, making certain that he understood the repayment schedule, interest fee, and any related charges. He additionally calculated the month-to-month funds to make sure they fit within his budget.

Managing the Loan

As soon as John obtained the funds, he used the loan to repay his present debts, including credit card balances and overdue bills. This not solely improved his credit utilization ratio but additionally helped him avoid late fees and potential legal action from creditors.

1. Creating a Budget

To handle his funds effectively, John created a finances that accounted for his new loan funds. He prioritized his expenses and regarded for tactics to cut costs, such as lowering discretionary spending and finding extra sources of earnings by means of freelance work.

2. Making Well timed Funds

John dedicated to creating well timed funds on his loan to avoid any unfavourable affect on his credit rating. He arrange automated payments to make sure he never missed a due date.

The result

Over the next few years, John efficiently paid off his personal loan and improved his credit score rating to 700. This accomplishment opened up new financial opportunities, allowing him to qualify for a mortgage and purchase a home for himself and his son.

Conclusion

This case examine illustrates the challenges faced by individuals with bad credit score when seeking personal loans. Nonetheless, with careful planning, analysis, and a commitment to monetary duty, it is possible to safe a loan and improve one’s monetary situation. By understanding the choices out there and making knowledgeable choices, borrowers like John can overcome their credit challenges and work towards a extra stable monetary future.

No listing found.